What Data Reveals About Billion-Dollar Startups

SUPER FOUNDERS

Ini keren bukunya. Udah nunda baca buku ini diseling oleh beberapa buku yang lain, ternyata nyesel, ternyata buku ini lebih keren daripada buku yang "menyeling", buku sebelumnya saya baca The $100 Startup - Chris Guillebeau.

Secara umum, buku ini menceritakan tentang bagaimana kecenderungan yang dimiliki oleh Startup dengan valuasi 1 Billion Dollar. Si penulis pakai data studi, membagi 2 kelompok data. yaitu kelompok 1 Billion Dollar Startup, dan 1 lagi adalah Random Group. Jadi dari 2 data tersebut bisai dibandingkan, apakah benar kecenderungan tertentu merupakan DNA dari Startup? atau hanya kebetulan? dan seterusnya.

Buku ini menampik beberapa mitos tentang startup / founder startup. Sebenernya saya baca sih ga menyangkal dengan pasti, cuman membuktikan fakta data tentang mitos2 dunia startup. Seperti.. Apakah harus dropout dari kuliah supaya bisa buat startup sukses? apakah harus di usia di bawah 30? dan seterusnya.

Buku ini ditulis di tahun 2020, ketika pandemi, dan dibahas juga impak krisis pandemi terhadap dunia startup.

1 kalimat dari saya untuk menggambarkan buku ini:

Bayangkan buku Good to Great, tapi membahas tentang Startup

1 kalimat dari saya untuk kesimpulan yang bisa saya ambil dari buku ini:

Siapapun bisa jadi startup, dimanapun, dengan modal berapapun. Apalagi di zaman super cepat ini.

buku ini cocok untuk siapa?

- siapapun yang sudah biasa dengan kosakata startup-startup-an, kalau tidak, jangan baca buku ini dulu

- yang biasa baca buku tentang bisnis / perusahaan Amerika. Padahal si penulis bukan orang Amerika, keren juga. Se-Googling saya sih, doi orang Turki, kuliah di Imperial (London), trus kuliah di Stanford..

berikut catatan pribadi saya tentang buku ini

- The founders of billion-dollar companies were more likely to either work for themselves or to work at a tier-one company.

- What is important, though, is that these founders kept on building until their luck came through. As they say, it takes hard work to get lucky.

- the lesson is that you don’t need to create the next billion-dollar company on the first try.

- ideating top-down can also produce great outcomes. Identify a trend or select a market, ideally pick a customer segment you may know better than others, and find real problems they face. Validate early on, and make sure what you’re working on is not a made-up problem.

- Don’t hire a sales and marketing team before the market is clearly pulling the product out of you.

- “One of the most common mistakes companies make is to try to inorganically grow the customer pipeline before the product is retaining existing customers. That amounts to pouring fuel into a leaky engine,”

- unfair advantage in either hiring great talent or striking partnerships.

- You have to notice the problems that many of us often ignore.

- Apple wasn’t competing with General Magic, but it wasn’t the first company to work on the smartphone idea either.

- when nine hundred venture capitalists were asked about what they considered the most important factor in the success of their portfolio companies, timing came in second, only after the makeup of the team,

- At a startup, speed is everything.

- The blog was a hit, with more than ten million monthly visitors,

- My own data on billion-dollar companies shows that more than 90 percent were venture backed.

- VCs are fine with companies that can lose 100 percent of their money at the very low possibility of making 10x the investment.

- Startups needed to cut costs, lower debt, and become real businesses.

- shy away from businesses that rely on human labor

- Be so good they can’t ignore you. You are almost always better off making your business better than you are making your pitch better.

- most successful portfolio companies, 64 percent again attributed the companies’ success to the team.

- “really good founder, really good idea, really good products, really good initial customers.

- www.nber.org/papers/w22587.

alasan VC membiayai Start Up - Founders should be very explicit about their company’s risks.

- Whereas companies on average used to take five and a half years from founding to IPO, that number is now over eight years.

- too good to ignore—

- When you’ve got a top-tier VC backing you, that gives you instant credibility. You’ve been vetted. We didn’t have that vetting.”

- The median billion-dollar startup raised its first round of funding just six months after founding and its second round in less than two years from founding.

- try to use anecdotal comparisons—for example, refer to it as something like “LinkedIn for doctors,”

- Painkillers were more likely to become billion-dollar startups, but vitamin pills that created a habit or strong brand worked too.

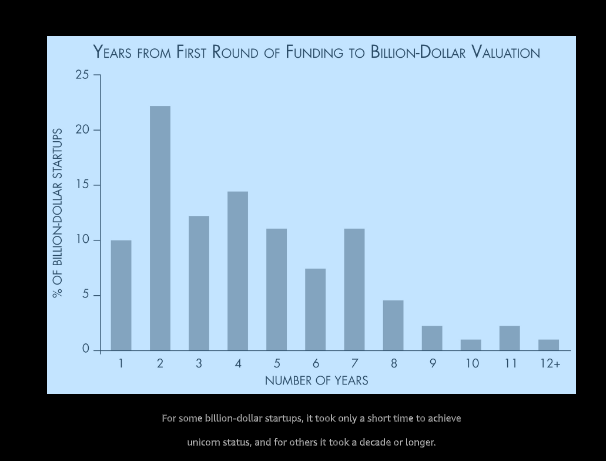

waktu dari pertama kali funding sampai jadi Billion Dollar Startup

0 Response to "Review Buku: Super Founders - Ali Tamaseb"

Posting Komentar